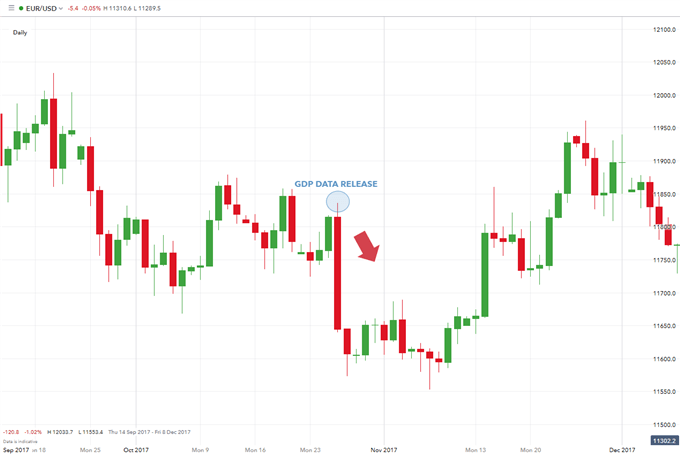

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The three most important types of Forex market analysis are:

It depends on the experience and what resonates with you as a trader. However, the experienced traders prefer to use a combination of all three to boost their portfolio. Since, each of the analysis technique will provide you more information and new insights about the Forex pair you are trading. In the upcoming lessons, we will take a closer look at the two most used Forex market analyses methods; Fundamental analysis and Technical analysis. We will dive into the specifics and show you how to become proficient in these areas, in order to become a trader that makes better trade decisions.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

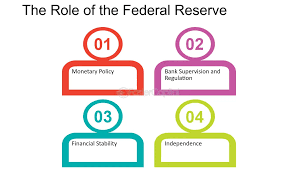

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of