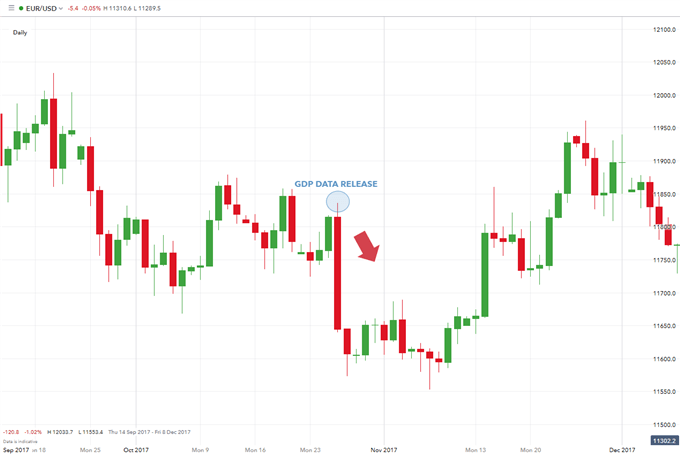

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

One of the main advantages, which make this strategy attractive for beginners, is the fact that there is no need to make any deep technical or fundamental analysis. Since the trader is only interested in what is happening on chart in any particular moment. When using scalping trading strategy trader is trying to catch just few points of profit in any particular entry, but because of using high leverage and making dozens of trades every day profit can be substantial.

The easiest way to understand the essence of scalping strategy is with the help of example. Let’s imagine that a trader has a deposit of $1000 and is using leverage of 1:5, then he/she can make transactions with 0.05 lots size, which will bring him/her $0.50 from one pip movement. And if trader considers that on average he/she is planning to earn 30-50 pips per day, then his/her maximum earnings would be around 15-25 dollars per day. With scalping trading strategy much higher leverage is used. Some scalpels use up to 1:100 leverage or even more. In case of using 1:100 leverage the trader can open entries with 1 lot size instead of previous 0,05 lot, this makes 1 pips value equal to 10$. In this case even making 10 pips profit in one day will give a trader 100$ profit.

Volatility is basically a price change for a certain instrument within particular timeframe. The more the instrument price moves during a trading session or a day, the greater the potential profit for scalper become.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

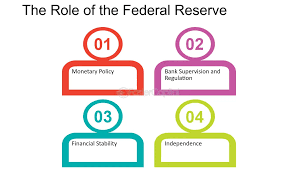

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of