Final GDP Reports: What They Mean for Forex Traders

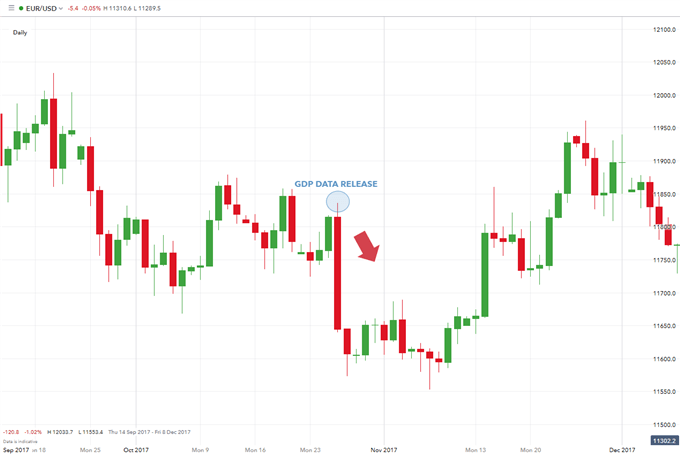

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

Technical analysis is the process by which Forex traders’ study and forecast price movement. The theory behind this is that a Forex trader can analyze historical price movements and then tries to determine the current trading conditions and potential price movement. The argument behind using technical analysis is that all the current market information can be seen in the price of a currency pair. What this means is that the price and its movement, either up or down, reflects all the information that is out there in the Forex market. Hence, there are Forex traders out there who solely rely on technical analysis to make a trading decision. Well, that’s basically what the technical analysis is all about. It’s core belief is that if a price level has formed a trend pattern in the past then it will also act in the same way in future. Some of the other benefits for technical analysis include:

Technical analysis reveals patterns that can be traded with a high probability of success.

Forex traders can make use of indicators to help them trade.

Trading in the direction of the trend puts the probabilities in your favor.

In the world of FX trading the first thing that comes to mind is a chart. Every technical analyst uses charts, as this is the easiest way to visualize historical statistics. In technical charts, traders can look at past data to spot historical trends and patterns that will help them to analyze some great trading opportunities. As most Forex traders start to take trade decisions on certain price levels and chart patterns, since the more likely that these patterns will replicate itself in the Forex market. But one thing traders should remember is that technical analysis is very subjective. That means, just because Mr. X and Mr. Y are looking at the exact same currency chart setup or indicators, it is not necessary that they end up with the same idea of where the price may be headed. In the coming lessons, we will take a look closer to the basic techniques of technical analysis. Hereafter, we will gradually dive into more advanced elements of technical analysis and also we will look into Forex trading strategies based on technical analysis.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

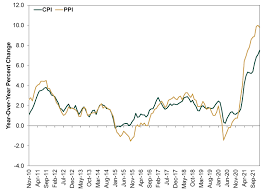

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of