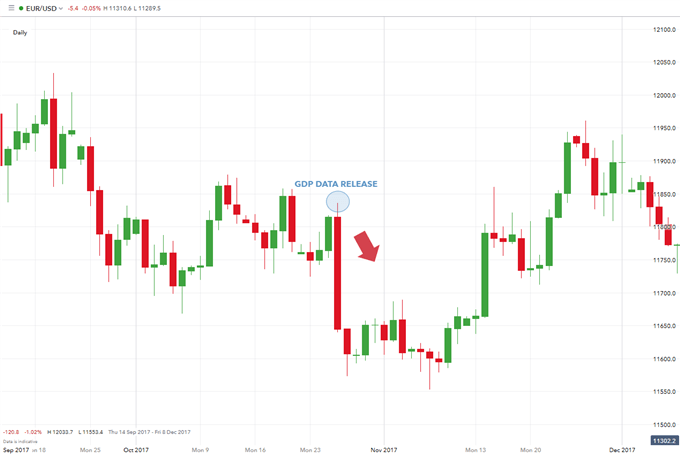

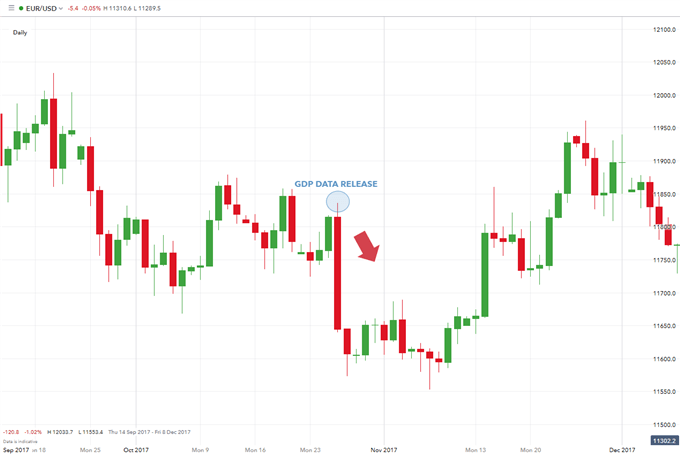

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

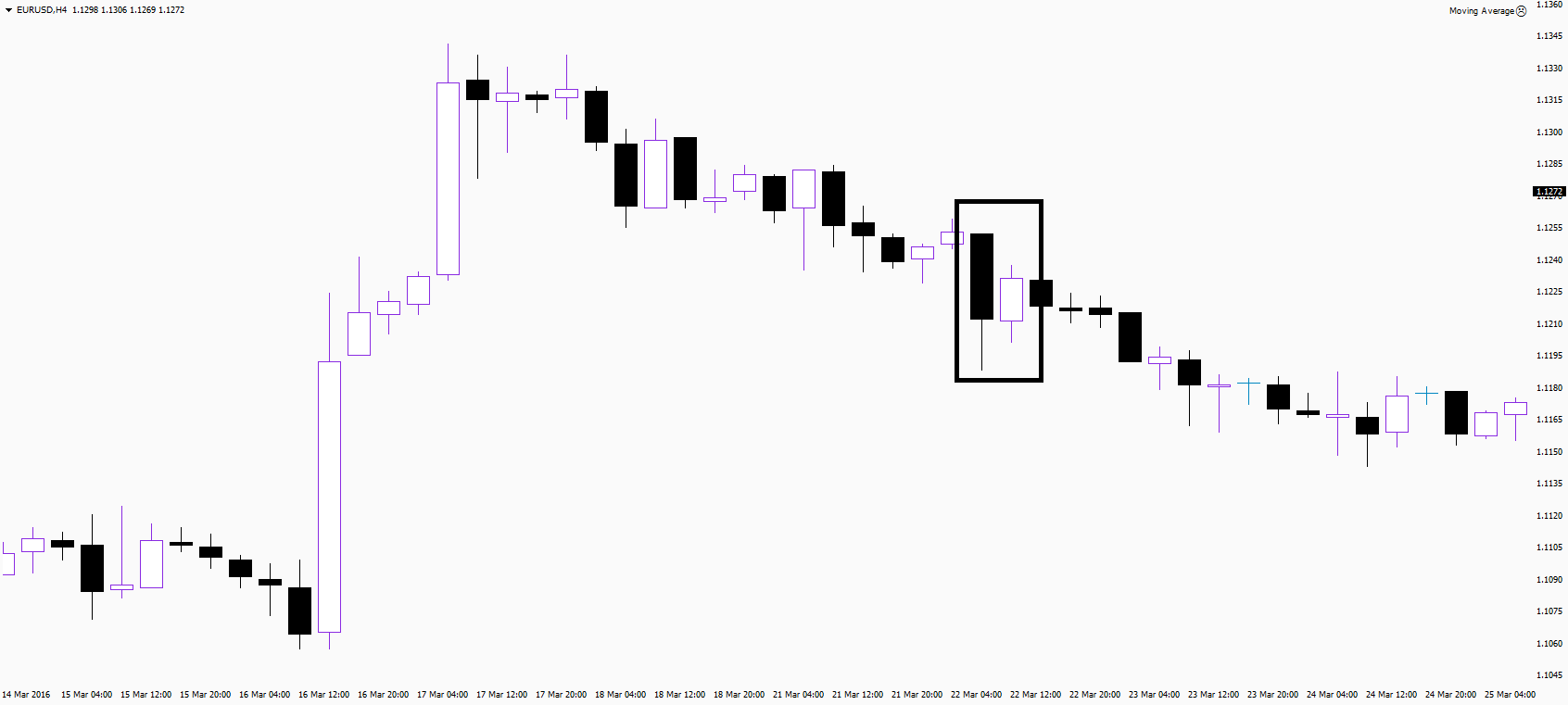

For example, if price went down to the previous support level, a pin bar appeared, and then the price went up. A pin bar shows that the price is trying to deceive you, it will not go down, you can safely open bullish entries. The same with the second pin bar, the price steadily went up, and then the pin bar appeared showing that bullish trend is coming to its end. So it happened, the price starts to fall.

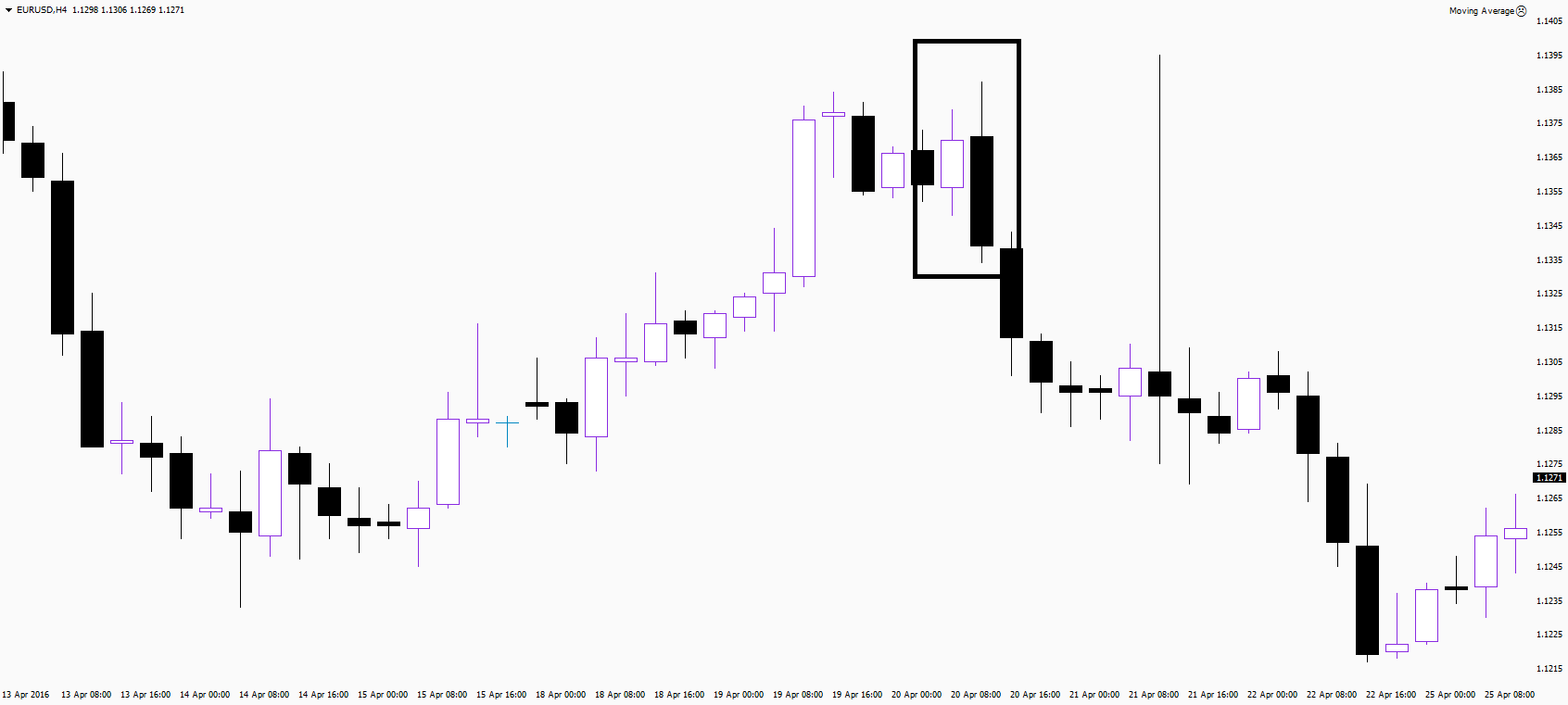

The price movement needs to have an opposite direction and a larger range. This means that the probability of a trend change is high. However, in order to start acting you should look at the next candle and if it confirms a trend change, then you can open trades.

is a combination of two candles. The Inside Bar pattern appears when the price range of the second candle is within the price range of the first candle. The inside bar is not a reversal pattern. And it is also not a continuation model. The price can go both up and down. It should be considered as an attention signal.

Price Action is not a complete trading system, but rather a technical analysis. Each trader develops his/her own strategy, starting from the simple basic price action principles: no indicators, only a clean chart. Furthermore, you should:

Remove all indicators and advisors from the chart.

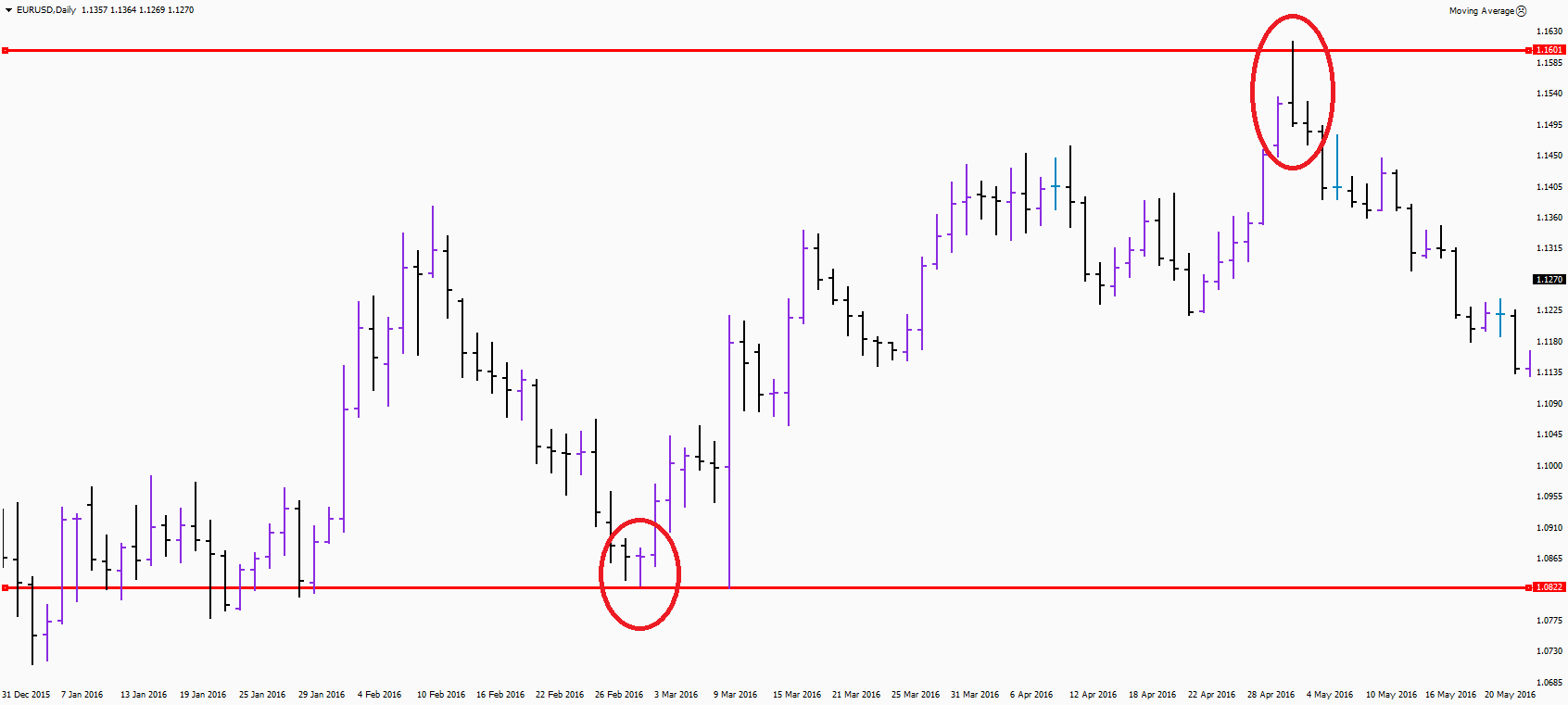

Look for important levels.

Open trades when one of candlestick patterns appears near important levels.

There are a lot of different patterns and pricing models. In this lesson only the basic pattern were described, but even those simple Price Actions patterns can help you become more profitable in Forex.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

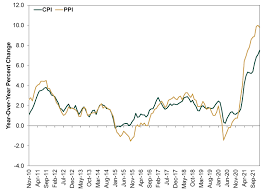

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of