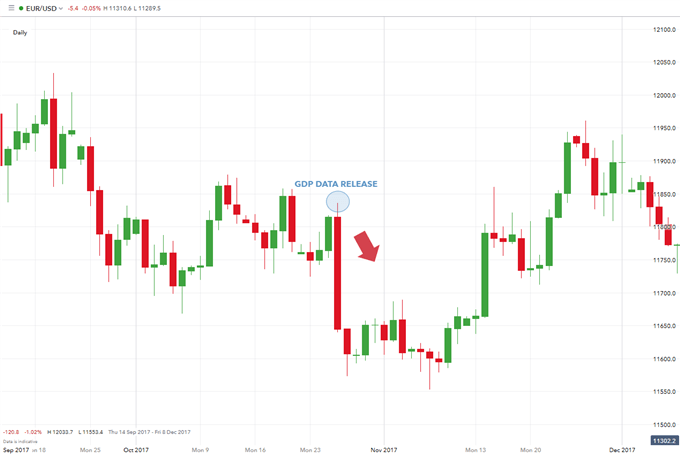

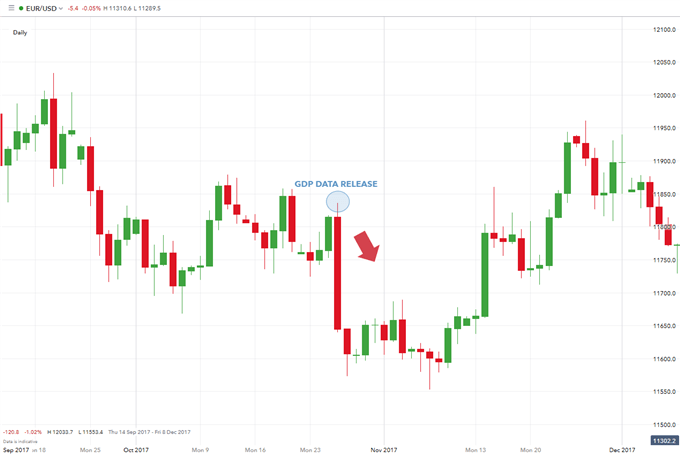

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

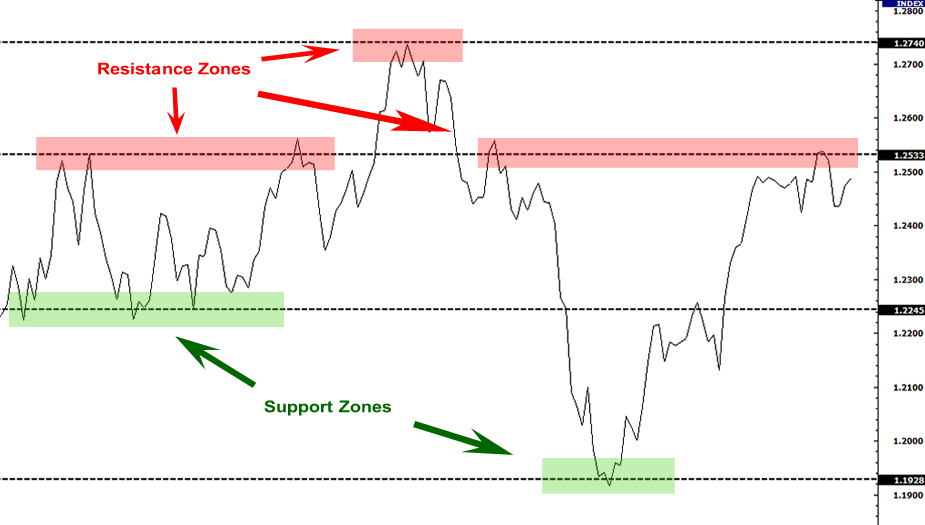

In fact, the support and resistance lines are a graphic representation of the struggle between buyers (bulls) and sellers (bears). Bulls push prices up, bears – down. The outcome of the struggle depends on the direction in which the price moves. Support is the level at which bulls control prices and prevent them from further decline. Resistance is the level at which bears control prices. If the price suits both bulls and bears, you can make a trade. Support levels reflect the price that gives the investor hope for an increase. Resistance levels are the opposite; they show the price from which the investor expects a decline. In order to trade pullbacks and breakouts correctly, it is important to determine whether the price is in relation to the of support/resistance levels. When the price approaches the level, three situations may arise:

Price breaks through the level and moves on.

Price breaks through the level, but then comes back, forming a false breakdown

The price tests the level and rebounds from it.

The Bounce:

one method of trading with support and resistance levels is right after the bounce. Many retail forex traders make mistakes in setting their orders directly on support and resistance levels and then just waiting to for their trade to happen.

This might work at times, but this kind of trading method assumes that a support or resistance level will hold without price getting there yet. When trading “the bounce”, you need to tilt the odds in our favor and find some sort of confirmation that the support or resistance will hold.

For example, instead of executing buy order, you need to wait for it to bounce first before entering. If you’ve been looking to go short, you need to wait for traded pair to bounce off resistance before entering. By doing this, you can avoid those situations where price of the currency pair moves fast and break through support and resistance levels.

The Break:

The Break: In the Forex market, support and resistance levels would hold forever. However, you could just jump in and out whenever price hits those major support and resistance levels and earn huge profits. The fact is that these levels break very often. So, it is not enough to just trade with “the bounce”. You should have an experience of what to do whenever support and resistance levels doesn’t work.

The Aggressive way:

The easiest way to trade breakouts is to buy or sell whenever price passes convincingly through a support or resistance levels. You only need to enter when price passes through a significant support or resistance level.

The Conservative Way:

If enough selling and liquidation of losing positions happens at the broken support level, price of the currency pair will reverse and start falling again. This is the main reason why broken support levels become resistance whenever they break. Taking the advantage of this phenomenon is all about being patient. Instead of entering right on the break, wait for price to make a pullback to the broken support or resistance level and enter after the price bounces.

An uptrend line is drawn along the bottom of easily identifiable support areas while in a downtrend, the trend line is drawn along the top of easily identifiable resistance zones. There are three types of trends:

Uptrend (higher lows)

Downtrend (lower highs)

Sideways trends (ranging)

To create an upward ascending channel, you need to simply draw a parallel line at the same angle as an uptrend line and then move that line to a position where it touches the most recent peak. And, to create a descending channel, you need to draw a parallel line at the same angle as the downtrend line and then move that line to a position where it touches the most recent valley.

Ascending channel (higher highs and higher lows).

Descending channel (lower higher and lower lows).

Horizontal channel (ranging).

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

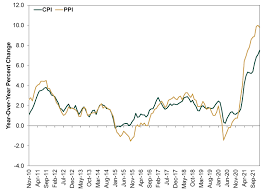

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of