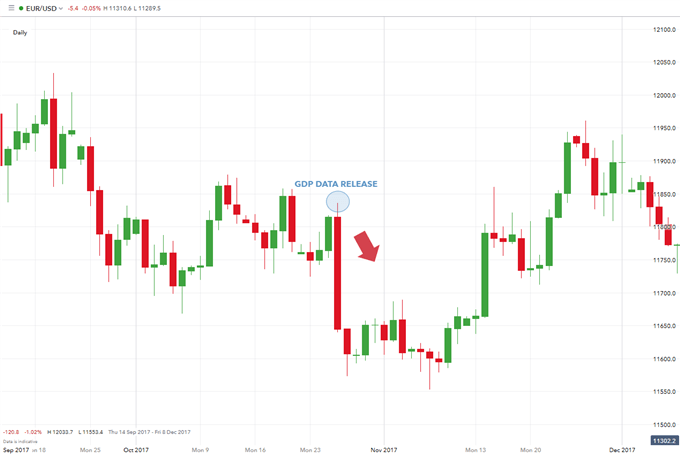

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

Hedging in the Forex market involves a trader investing in multiple positions to minimize the risk by taking a negligible loss or a small profit, no matter of the market volatility. The main goal behind hedging is to cover all market eventualities and to prevent significant losses in trading. Forex traders use hedging if they are unsure about the future course of the market. Or, if they anticipate huge swings on either side of their trade position due to unpredictable news outcomes.

In Forex trading, it works on the principle of a trader buying and selling a currency at a single-entry price to ensure that he or she is protected even if the market swings aggressively in either direction. The process involves a single currency pair that has a common base currency. Some Forex traders use correlation to find different currency pairs with positive or negative correlation with each other, and then enter a buy or sell position according to their market research.

In the case of a positive correlation, most Forex traders usually go long on currency pairs that are expected to rise. Meanwhile, the Forex traders can go short on those currency pairs that are expected to decline. In a negative correlation, Forex traders go long on the first currency pair while going short on the correlated asset. Sometimes, traders may also use a combination of positive and negative correlation to hedge their positions. This concept is considered to be a low-risk strategy with very limited potential for both profits and losses. It can be used for opening orders on single currency pairs, but also two different currency pairs. Hedging can be regarded as a profitable strategy only if a trader is experienced and can make profitable trades by accounting for all the costs of trading.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

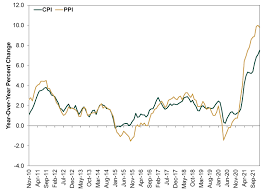

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of