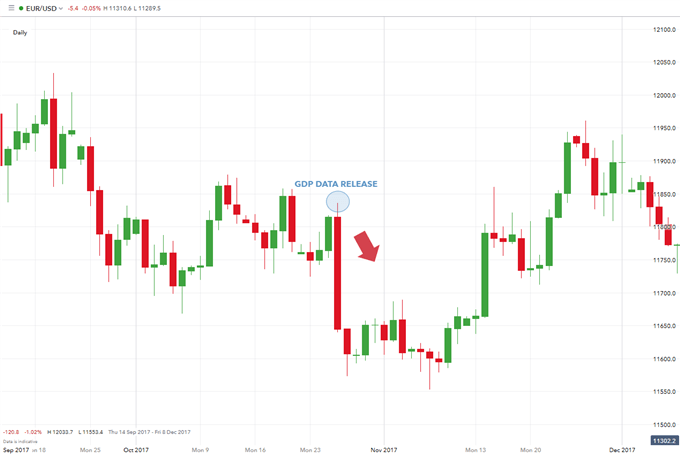

Final GDP Reports: What They Mean for Forex Traders

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The capital market is where individuals and institutions trade financial securities. Consisting out of a primary and secondary market.

The bond market, or also called the Primary market, is where bonds and shares are created for the first time and traded without any middleman.

The stock market, or also called the secondary market, is where investors can buy securities; stocks, futures, bonds, and options. You will buy these financial instruments from a middleman or other investors. This happens through an exchange, so not direct from the firm or institution like with the primary market.

In this market individuals, institutions, and companies trade financial instruments with high liquidity and short maturities, meaning that it is generally traded on the short-term and under 1 year.

Also known as the Forex market, this market deals with the exchange of currencies from all the countries in the world. Countries, governments, institutions, large and small corporations, but also individuals are participating in the Forex market.

Inexperienced traders do not commonly trade this market, as it has another layer of complexity. It is it called the derivative market, since a derivative’s value is derived from its underlying asset or assets such as forwards, options, futures, swaps, Contracts-For-Difference (CFDs) or other forms.

The over-the-counter (OTC) market is a secondary market, also known as the dealer market. The term, over-the-counter, means that the stocks are not trading on a stock exchange. This results into less regulation; the most of securities traded this way are penny stocks and shares from small companies.

Although, it is not regulated like all the other financial markets and some people believe it would fail, this decentralized market has changed the global financial markets since its entrance in 2009. The major digital coins traded or owned are Bitcoin, Ethereum and Ripple. Cryptocurrencies are a by-product of the blockchain technology. These digital tokens were created based on the blockchain technology. From all these financial markets, the Forex market is the largest financial market in the world. The daily amount of currencies traded exceeds $5 trillion, making it a lucrative and appealing market for individuals to enter.

Gross Domestic Product (GDP) is a key indicator of economic health. For forex traders, final GDP reports offer valuable insights into economic performance and future

The Federal Reserve (Fed) plays a pivotal role in shaping market trends through its monetary policy decisions. For forex traders, understanding the Fed’s actions and

Weekly unemployment claims provide a timely gauge of the U.S. labor market’s health, making them a crucial indicator for forex traders. Understanding Unemployment Claims: These

The Federal Open Market Committee (FOMC) is responsible for setting the U.S. monetary policy, making it a critical focus for forex traders. Understanding FOMC decisions

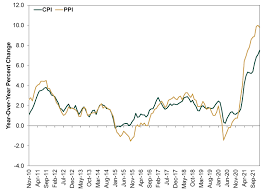

Consumer Price Index (CPI) and Producer Price Index (PPI) are two vital indicators used to measure inflation. Understanding the differences between these indices is crucial

Non-Farm Payrolls (NFP) is a critical economic indicator that provides insights into the health of the U.S. labor market. Released monthly by the Bureau of